User Review

( votes)Summary

Pepperstone Limited, a wholly owned subsidiary of Pepperstone Group Limited, is an Australian online trading company that was launched in 2010. In Nov 2016, Pepperstone Limited launched its UK operations with the intention of offering European and UK traders access to excellent customer support and trading conditions.

Pros

• Authorized and regulated online trading broker

• Personalized customer support

• Wide range of trading tools

• Choose from 11 MetraTrader and cTrader platforms

• Protects trader funds by maintaining them in separate bank accounts

Cons

• Demo account remains valid only for 30 days

• Does not accept US traders

• No protection for negative balance

Pepperstone is the winner of the following industry awards:

- Six Australia FX Report – Investment Trends 2017 awards for best customer service, spreads, value for money, education materials, risk management, and fund withdrawal

- The online Forex broker won the Best Global Forex ECN Broker Award and the Best Forex Trading Support – Europe Award from the Global Forex Awards in 2019.

- Three UK Forex awards in 2018 for best forex trading support, best forex ECN broker, and best forex trading conditions

- Two Compare Forex Brokers.com.au awards in 2018 for best Australian broker and best trading platform

- Ernst & Young Entrepreneur of the Year 2014

- Deloitte 2013 Technology Fast 50 Award 2013

- Best Intelligent Platform 2012 Award

- Pepperstone Factsheet 2026

- How Reliable Is Pepperstone?

- Why Choose This Broker?

- Types of Trading Accounts

- Choose from 11 Trading Platforms

- Trading Instruments

- Guide to Making Deposits

- Frequently Asked Questions about Pepperstone

- Is Pepperstone a good broker?

- Is Pepperstone an ECN broker?

- What is the minimum deposit for Pepperstone?

- Does Pepperstone allow scalping?

- How does Pepperstone make money?

- When does the rollover occur?

- Why didn't I receive my login details?

- How long does it take to make withdrawals?

- Can Pepperstone teach me how to trade or trade on my behalf?

- What is the maximum leverage offered by Pepperstone?

- Overall Rating of Pepperstone & Conclusion

Pepperstone Factsheet 2026

- Excellent trading platform

Pepperstone uses technology to give its clients a top-notch experience. A trader has 11 platforms to choose from. This includes the popular MT4, MT 5, and cTrader.

- Spreads and commission

The spreads offered on the MT4 platform are variable and customer-oriented. The quotes are sourced from the 22 major banks and electronic crossing networks. This shows the company’s commitment to offering its client the best prices ever.

- Flexible leverage

The leverage amount differs and depends on whether you qualify as a professional or retail trader. For professionals, the leverage ratio may be 500:1 and 1:30 for retail traders. Their flexibility approach is a tick since it shows the company cares about individual clients.

- Mobile apps

Whether you are using an android device or iPhone you can use Pepperstone mobile app to trade instruments. But, you only use this platform if you are using the MT4 trading platform.

- Customer support

The company is always committed to discussing any complaints or queries. You can reach them through a phone call, email address, or live support. This support is provided 24/5.

- Auto trading

To ensure you get the best from the platform, Pepperstone allows one to auto trade and you can receive trading signals to help you make a formidable decision.

How Reliable Is Pepperstone?

Pepperstone is a licensed and well-regulated Forex broker. We suggest that you read the legal documentation for Pepperstone Limited (UK and EEA) and Pepperstone Group Limited (Australia) to get more information about the company’s anti-money laundering policies, risk disclosure statement, privacy policy, and so on. You will find this documentation on the official website.

You can also use the following details to contact a customer support agent:

- Telephone – Call the toll-free number +44(800)0465473 for UK, 1300-033-375 (local Australia call), +61-3-9020-0155 (phone), and +61-3-8679-4408 (fax).

- Email – Send an email to [email protected].

- Online Contact Form – Use the online contact form to send customer support a message.

Why Choose This Broker?

Traders have a wide choice when it comes to forex providers, but many of them choose Pepperstone for the following reasons:

- Excellent Trading Platform – Forex trading on Pepperstone is convenient, cost-effective, and fast. It offers popular trading platforms such as cTrader and MetaTrader4 along with spreads that start from as low as 0.0 pips.

- Implements Latest Technologies – The Pepperstone platform is based on the latest technologies and offer spreads and liquidity that were so far available only to hedge funds and banks. The online trading platform is reliable, efficient, and fast.

- High Quality Trading Experience – Customers can enjoy institution grade trading without any catch or complex account structure. The Forex broker executes trades fast and at costs as low as EUR/USD0.0. Moreover, it applies a minimum account size of AU$200 and welcomes different styles of trading.

- Trading Tools – Pepperstone offers a wide range of tools, including WebTrader, mobile apps, proprietary client areas, and advanced account analytics.

- Authorized and Regulated – The FX broker is well-regulated and licensed. It maintains player funds separately in noted banks such as Barclays (UK) and National Australia Bank (Australia). The online forex broker is regulated and authorized by the UK Financial Conduct Authority (FCA) and the Australian Securities and Investment Commission (ASIC).

- Customer Support – Pepperstone has won several awards in recognition and appreciation of its excellent customer support. The broker offers personalized customer support. Since its customer support team has several years of experience in the forex trading industry, it is capable of helping traders achieve their goals.

- Refer-a-friend Bonus – Pepperstone.com rewards you with a bonus of US$100 if you refer someone to its services and that someone deposits more than US$1000 into his/her online trading account and trades at least five Forex lots.

- Premium Client Service – Premium clients are those who do high-volume online Forex trading at Pepperstone.com. The online FX broker rewards premium clients with premium cashback offers, priority customer care, invitations to premium trading events, advanced market insights, advanced trading tools, and VPS solutions.

- Active Trader Program – High-volume FX traders can claim cash rebates and save plenty of money on commissions at Pepperstone.com. But your rebate amount depends on the number of lots you trade every month. This means that you need to trade more for higher rebates.

- Education – Pepperstone offers plenty of educational resources in the form of online trading guides, articles, and webinars. This information helps traders to trade successfully and make bigger profits.

- Market Analysis – This is another interesting feature of Pepperstone.com, encompassing details of major financial events, commentaries, videos, and others. You can get the latest market news, trading opportunities, financial events, and economic calendar, among others.

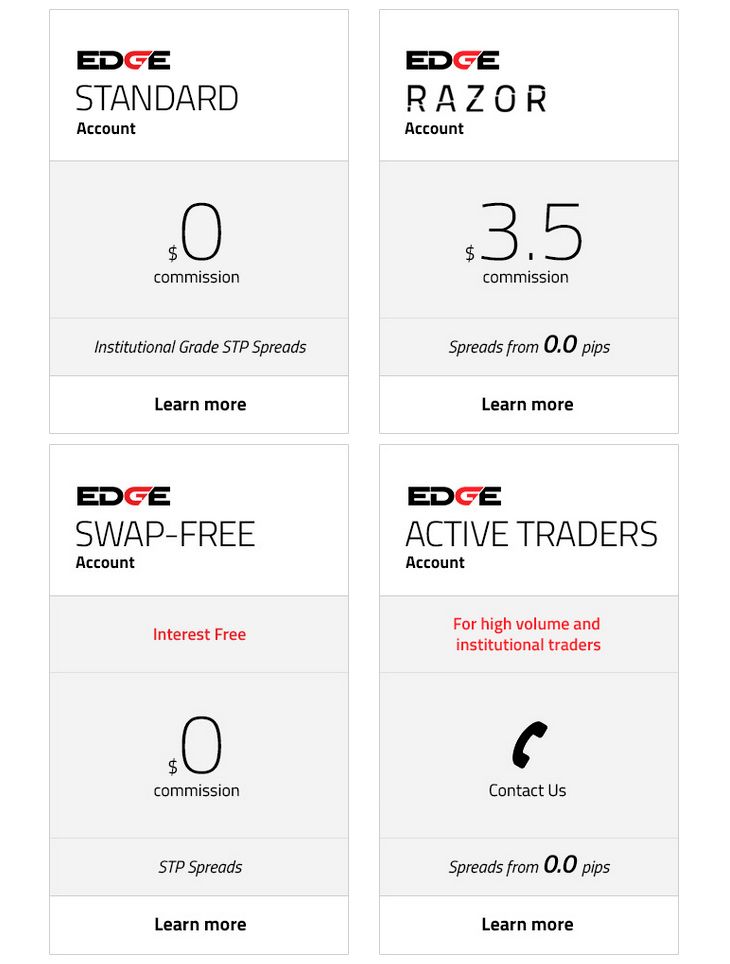

Types of Trading Accounts

You can open two types of accounts at Pepperstone:

Demo Account

The ideal way to get started at Pepperstone is to open a demo account and practice trading without risking any real money. Demo accounts remain valid for 30 days at the online broker. New customers can open a demo account and get virtual money up to $50,000 in just three steps:

- Choose your account type (demo account) from the dropdown box.

- Check the box against the declaration that you are above 18 years of age and that you agree to the company’s policies.

- Sign up through your Google, LinkedIn, and Facebook accounts.

- Traders preferring to sign up using their details can input their name, email address, and phone number and create a password before clicking on the Register button.

Following the above steps makes traders holders of demo accounts at the Forex broker. They can now log in to their secure client area, download a trading platform, and practice trading without taking any risks.

Live Account

The procedure to opening a live account is similar to that of opening a demo account.

- Choose Account Type – You can choose account types such as individual, company, trust, trust corporate, and introducing broker.

- Enter Your Details – You have to select your country of residence, enter details such as name and email address and create a password before clicking on the green Register button.

- Register with Social Accounts – Alternatively, you can register with social networking accounts such as LinkedIn, Google, and Facebook.

Choose from 11 Trading Platforms

The Forex broker offers 11 trading platforms including cTrader and MetaTrader for mobile, Mac, and desktop.

MetaTrader 4 Platform

This platform features a user friendly interface along with a customizable online forex trading environment so that traders can get the best out of their trading activities. Some of the other desirable features of this platform include the MQL language, which enables traders to program indicators and expert advisors (EAs), which can trade in forex 24/5 automatically.

The key features of MetaTrader include 85 previously installed indicators, market watch window, multiple order types, navigator window, multiple chart setups, analysis tools, order execution capabilities, multiple chart setups, and analysis tools.

cTrader

The cTrader platform, which includes the cTrader cAlgo, cTrader Mobile, and cTrader WebTrader, is considered to be among the most sophisticated, revolutionary, and innovative trading platforms in the market.

cTrader is user friendly and highly customizable. It offers detachable charts and pre-sets for amateurs and professionals. Customers can efficiently manage their positions through its order management and enhanced charting systems. The key features of this trading platform include automated trading through dedicated platforms, charting techniques, extensive back testing facilities, detachable charts, and level II pricing.

Trading Instruments

Pepperstone offers a complete product suite so that it can meet the requirements of different types of traders. It offers trading in over 70 currencies, commodities such as natural gas and oil, metals such as silver and gold, and a variety of indices.

- Forex Trading – The broker was originally established to provide forex trading services. Although it has expanded its product range, its focus continues to be on forex trading. The spreads start as low as 0.0 pips on currency pairs such as AUD/USD, USD/JPY, EUR/USD, and USD/JPY. The focus is also heavy on high-quality execution, leverage of up to 500:1 for professional traders and 30:1 for retail customers, low latency, and reliable infrastructure.

- Index CFD Trading – The broker’s index CFDs come with no requotes, low latency, and no hidden markups. Traders can trade on 14 major stock indexes across the globe.

- Precious Metals – Pepperstone’s fast execution, no commission, flexible leverage options, and cost-effective pricing models make it very easy to trade on precious metals such as palladium, platinum, silver, and gold.

- Energy – Trading on Brent Crude Oil as well as West Texas Intermediate Crude Oil along with Natural Gas. All energy trading instruments at Pepperstone have trade sizes that start from 10c per pip, no commission, up to 30:1 leverage for retail traders, and up to 500:1 leverage for professional traders.

- Cryptocurrencies – Trading on cryptocurrencies such as Ethereum, Bitcoin Cash, Bitcoin, Litecoin, and Dash against the US Dollar. Leverage of up to 5:1 is available for professionals and up to 2:1 is available for retail customers.

- Soft Commodities – The FX broker also offers trading on sugar, coffee, orange juice, cotton, and cocoa.

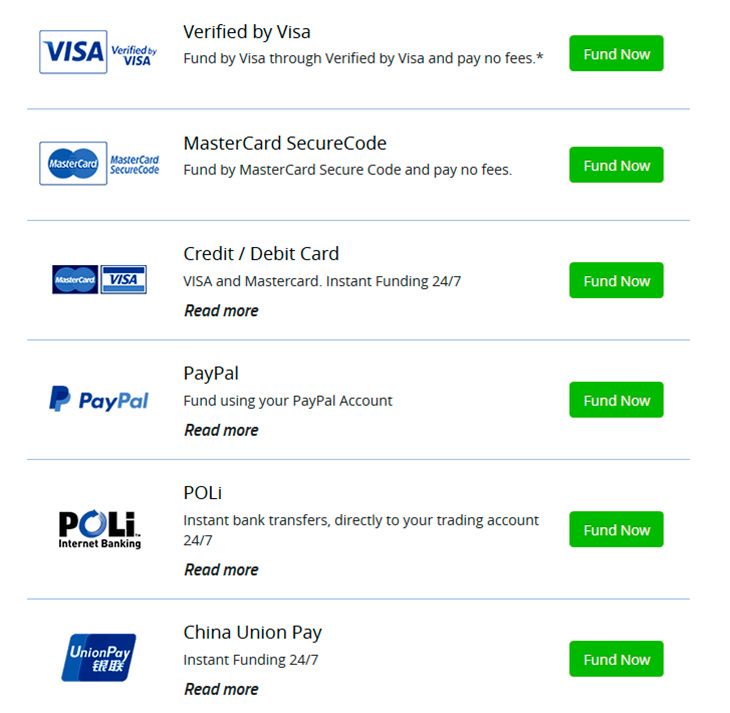

Guide to Making Deposits

Pepperstone offers the following payment methods:

- Visa & MasterCard Credit/Debit Cards – Deposits take 24 hours to process, and you can make deposits in AUD, GBP, EUR, NXD, USD, SGD, and JPY. The transaction fee is 1.8% for AUD and 3% for deposits made in other currencies.

- Skrill – Skrill deposits are instantly credited to accounts. There is no transaction fee and the accepted currencies are AUD, USD, JPY, and EUR.

- Neteller – Neteller deposits are instant and the transaction fee is zero for deposits. However, traders using Neteller to withdraw profits have to pay a fee of US$1. The accepted currencies are JPY, GBP, AUD, EUR, and USD.

- Broker to Broker – You can move funds from your existing broker account to your Pepperstone account. It takes 2 – 3 days for the deposits to get credited to accounts.

Pepperstone does not charge any deposit fees, but banks and online processing companies do. Also, the company does not accept payments from third parties, which is why customer’s preferred payment method is in their name, not somebody else’s.

How to Withdraw Profits

To make a withdrawal, you have to first log in to your trading accounts. Pepperstone processes all payout requests received before 21:00 GMT on the same day. If you submit any withdrawal request after 21:00 GMT, it will process those requests on the following day.

If the broker’s banking institution charges international telegraphic transfer (TT) fees, the company will pass them on to the trader. Usually, TTs come up to P15. Bank wire withdrawals take 1 – 3 banking days, but may also take longer in case of unforeseen circumstances.

Frequently Asked Questions about Pepperstone

Is Pepperstone a good broker?

Yes. Pepperstone broker is a reputable Australian forex broker that was established in 2010. In 2015, the company went ahead to open another office in London to serve the EU clientele base. It is safe since it is regulated by two top tier financial authorities namely; the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

Is Pepperstone an ECN broker?

Yes. Pepperstone allows its clients to use ECN (electronic communications networks) execution model.

What is the minimum deposit for Pepperstone?

In Pepperstone, the recommended minimum deposit under standard and razor account is $200. However, clients are free to deposit anything below this amount. The good thing about this platform is that there is no formal stipulated minimum deposit that a trader is required to deposit.

Does Pepperstone allow scalping?

All Pepperstone accounts allow scalping, trading robots, and hedging. However, the razor account is best suited in this trading strategy.

How does Pepperstone make money?

Pepperstone will make money from the spread that is the difference between the bid price and ask price on the trader's contract. Also, the company earns a commission on all the instruments offered by the company. However, the amount of money the company earns depends on the platform used.

When does the rollover occur?

The Pepperstone rollover occurs between 23:59 – 00:01, MT4 server time which is currently on GMT +3. The roller time coincides with that of New York markets close which takes place at 5 pm.

Why didn't I receive my login details?

At all times, the company will work tirelessly to give you a top-notch experience. If you don’t receive your login details with 24 hours check your email inbox. The customer support system may have tried to contact you to resolve any underlying issues with your application. Also, you can contact customer care via [email protected].

How long does it take to make withdrawals?

All withdrawals are processed during the business days in Australia within the working hours. Typically, it takes 1 business day to process the application. Withdrawal ETAs depends on the withdrawal method chosen.

Can Pepperstone teach me how to trade or trade on my behalf?

Neither can Pepperstone offer any training nor make decisions on your behalf. But, Pepperstone has a team of experienced staff who can offer insights that would make you better off. Despite all these efforts, the final trading decision lies with you.

What is the maximum leverage offered by Pepperstone?

The maximum leverage offered by Pepperstone depends on your location. All clients of Pepperstone Group LTD (the Australian branch) equal 500 to 1 while clients of Pepperstone LTD (the U.K. branch) are limited to 30 to 1.

Overall Rating of Pepperstone & Conclusion

Pepperstone is a highly reputed online forex trading company in Australia and UK. Since it hasn’t developed an online trading platform in house, it allows traders to trade on cTrader and MetaTrader 4. Traders have a wide range of accounts to choose from and 90 types of assets to trade on. The spreads are tight with no commission or low commission.

Considering all the above facts, one can safely conclude that Pepperstone is definitely worth recommending. We suggest that you get started with a demo account before moving on to a live account. New customers can also get educated through the online forex broker’s webinars, informative trading articles, trading guides, and trading glossaries.