Forex trading also goes under the names of FX, currency trading, or foreign exchange. It is a global decentralized market for trading all the currencies of the world. The foreign exchange market is not only huge, but also has high liquidity. Its daily average trading volume is more than $5 trillion as Forex trading is full of opportunities that cannot be found in other forms of trading.

- How Forex Works – Understanding the Basics

- Making Money by Forex Trading

- How to Read Forex Quotes

- Important Forex Trading Terms

- CFD Trading vs. Forex

- Forex Indicators That Actually Work

- How to Choose the Best Forex Broker?

- MetaTrader 4 or MetaTrader 5 – Understand the Difference

- Forex Strategies Revealed

- Conclusion

How Forex Works – Understanding the Basics

Whenever currencies are purchased, a surplus demand for them is created in the Forex market. This pushes the price of those currencies higher. Whenever currencies are sold, a surplus supply is created in the Forex market. This pushes the price of those currencies lower.

Major players such as national banks are capable of creating huge waves in the Forex market by purposely creating surplus supply or demand for the currency of their country. The trading activities of individuals also have an impact, especially when a large number of individuals make similar trades.

Making Money by Forex Trading

Whenever individuals trade on the Forex market, they either purchase or sell a particular currency. The aim is to use one currency to purchase another in the hopes that the price of the purchased currency will go up. Once the price goes up, traders sell the currency they had just purchased.

For example, a trader buys 10,000 EUR at an exchange rate of 1.1600 with US Dollars. A couple of weeks later, the same trader sells the 10,000 EUR at an increased exchange rate of 1.2400. As a result of this trade, the trader became richer by $800.

How to Read Forex Quotes

FX brokers provide currency quotes in pairs such as USD/GBP, EUR/USD, JPY/EUR, and others. They quote currencies in pairs because Forex trades involve paying a particular currency to purchase another currency.

A good example for a currency quote is GBP/USD = 1.50247. The first currency in the pair is called base currency and the second currency is called the quote currency or the counter currency. In case of the example provided, the base currency is GBP and the counter currency is USD. 1.50247 is the amount a trader has to pay to purchase a unit of the base currency, which is GBP in this case. In other words, traders can purchase 1.50247 USD for one GBP. In doing so, they are actually selling GBP and buying USD.

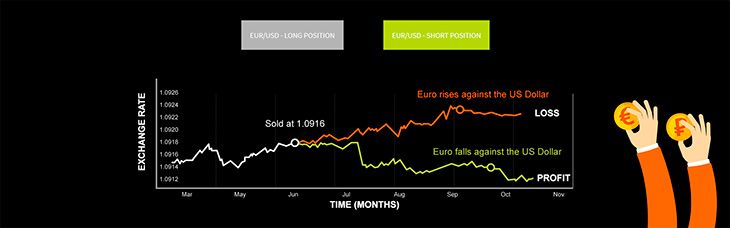

Long & Short

If a trader purchases the base currency and sells the counter currency, he/she is doing so with the hopes that the base currency will increase in value so that he/she can sell it at a higher rate and make a profit. In this case, the trader is “taking a long position,” a term that is also known as “going long.”

If a trader sells the base currency and purchases the counter currency, he/she is doing it with the hopes that the value of the base currency will fall so that he/she can purchase it at a lower price. By doing so, the trader is “taking a short position,” a term that is also known as “going short.”

Important Forex Trading Terms

- The term “bid” refers to the rate at which the broker is ready to purchase base currency for the counter currency.

- The term “ask” refers to the rate at which the broker is ready to sell the base currency for the counter currency.

- The term “spread” is used to calculate the difference found between the “ask” and “bid” amount. For example, if the bid for the currency pair refers EUR/USD is 1.34468 and the ask is 1.34498, the spread is the difference between the two.

CFD Trading vs. Forex

The following are the similarities between CFD trading and Forex:

- The trade execution procedure is similar.

- The pricing methods and charts are similar.

- While other trading instruments involve fees and commissions, the spread is the only cost involved in Forex and CFD trading.

- In both Forex trading and CFD trading, traders do not own the asset. They just speculate on the price.

The following are the differences between the two:

- While Forex trading involves making trades in currencies, CFD trading involves making trades in a wide range of markets such as energy, metals, and indices.

- Factors such as demand and supply of commodities impact CFD trades while global events such as changes in international policies and employment shifts impact Forex trades.

Forex Indicators That Actually Work

Some experts say that Forex indicators don’t really exist. Seasoned stock traders have created indicators, which traders on other markets use. There are many such indicators around, and new traders make the mistake of thinking that they are surefire ways to success. But it is not really the indicators, but the price movements that have to be considered while trading on all markets, and that includes the Forex market.

Here is a list of popular indicators used while Forex trading:

- Price Charts – Traders have to study the price charts and analyze them carefully to make a successful trade.

- Candlesticks – Candlesticks are powerful indicators that provide plenty of information about the main participants of the Forex market. This information is essential to help traders decide whether to take a long or a short position or just take a break from the market for a specific period of time.

- Bar Charts – These tools also provide the same information that candlesticks do, but they are easier to understand and analyze than candlesticks because of their appearance and shape.

- Bollinger Bands – These powerful Forex indicators inform traders on how far the market has deviated from the average.

- Stochastic Oscillator – Forex traders should study this indicator to understand the speed and momentum of a price. However, this tool has to be used carefully as a wrong analysis of it can lead to huge losses.

How to Choose the Best Forex Broker?

To become a successful Forex trader, one has to first select a good Forex broker. Here are some tips to help you choose an online Forex broker who best suits your requirements:

- Regulation – Choose an online Forex broker who is operating under a valid financial license granted by a reputed body.

- Leverage – Brokers extend loans called leverages to small account holders. For example, if the company offers a leverage of 50:1, traders with $1000 in their accounts can enjoy a position value of $50,000. While this increases traders’ changes of making profitable trades, it also increases their chances of losing a lot of money. Therefore, traders should be very careful about using the leverage offered by their brokers.

- Spreads and Commissions – Brokers earn profits through spreads and commissions. In case of some brokers, traders will have to pay part of the spread as commission. But there are brokers that do not charge commission. Instead, they widen the spread so that they can earn an income. They could charge fixed spreads or variable spreads.

- First Deposit – If you are a new Forex trader, you have to search for a broker who accepts small first deposits. The best brokers make it all the easier for their customers by offering several types of accounts with different first deposit amounts. Traders can just choose an account that best suits their requirements.

- Banking Methods – The best online Forex brokers offer a wide range of safe, secure, and reliable banking methods, including credit/debit cards, electronic wallets, online banking, checks, and so on. Traders can withdraw their profits through wire transfer or checks. Some brokers charge a fee for this service while others do not. Traders should, therefore, spend some time researching the banking options before they sign up.

- Customer Support – Before registering at an online broker, traders have to test the customer support for promptness and courteousness. Ideally, a Forex broker should offer 24/7 customer support through email, live chat, and toll-free telephone.

- Trading Platforms – The best Forex traders offer user friendly software, visually pleasing website designs, and a wide range of trading tools. The buy and sell options are clear, easily visible, and easy to click on. Top Forex brokers also include a panic button to allow traders to close all their trades. They also allow traders to create free demo accounts to start with so that they can practice trading till they become good enough to trade for real money.

Here is a list of Top Forex brokers to sign up at:

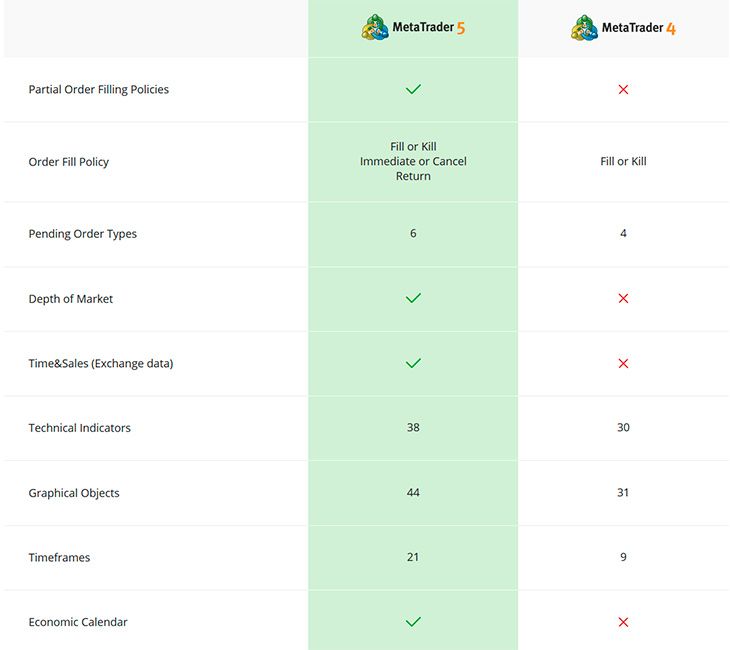

MetaTrader 4 or MetaTrader 5 – Understand the Difference

Traders can choose from two trading platforms: MT4 or MT5.

The MetaTrader 4 platform is the wider known of the two and all Forex brokers offer this platform. The MetaTrader 5 platform is lesser known. Interestingly, both platforms were developed by the same company—MetaQuotes Software Corporation, which has its headquarters in Cyprus.

Since the company released MetaTrader 5 five years after it released MetaTrader 4, many traders feel that MT 5 is just an improved version of MT 4. But nothing could be farther than the truth.

The truth is that MetaTrader 5 is capable of doing everything that MetaTrader 4 was designed to do, but it was developed for commodities and stock trading. In other words, MetaTrader 5 can be plugged into centralized trading exchanges, which is not essential for a decentralized market such as Forex.

Also, MetaQuotes developed MT5 in compliance with the US government’s no hedging law. While MT4 can handle hedging, MT5 is unable to do so. While this feature serves US traders well, it can be annoying for traders residing in countries that allow hedging.

Forex Strategies Revealed

If you are beginner searching for Forex strategies online, you will be overwhelmed with the large number of strategies available. Test each strategy in the demo account before trying it out for real. However, the best Forex strategy is one you create on your own after carefully considering your trading style and personality traits. Also, your chosen Forex strategy becomes effective only when you combine it with proper risk management and money management techniques.

Conclusion

Forex trading is exciting and profitable, but fraught with challenges. Since the Forex market is the most liquid market in the world, traders can easily enter and exit positions in any major currencies within the smallest time frame and for small spreads. At the same time, Forex brokers offer high leverage, enabling traders to control big positions without much of a bankroll.

We advise new Forex traders to choose their online broker with care and understand the risks that come with leverage. We suggest opening a free demo account and spending several hours in practice before actually trading on currencies for real.