The importance of choosing the right broker to trade binary options cannot be stressed too much. Traders have to take extra care while choosing an online trading platform or online binary options broker because there are too many fraud or scam brokers in the industry.

Binary options traders have to be prepared to spend several days in just researching various trading platforms. They should be smart enough not just to win trades, but also choose the right broker to trade with so that they can rest assured that they can withdraw their profits without hassles.

- Which are the Best Brokers for Binary Trading?

- Top binary options brokers fact sheet 2026

- Comparing Brokers and Platforms

- 5 Tips to Choose a Binary Options Broker

- A Word on Regulation and Why It Matters

- TOP 2 Regulated Binary Brokers in 2026

- Should You Use Multiple Brokers?

- Frequently Asked Questions

- Which is the best binary options broker for a beginner?

- Which asset should I buy?

- Is trading binary options legal?

- Is it good to trade with many brokers?

- Who regulates brokers in the UK?

- Which binary broker should I choose?

- Can I trade binary options when 15 years old?

- What should I consider when choosing an online broker?

- Conclusion

Which are the Best Brokers for Binary Trading?

#1 IQ Option

Trade Stocks, Forex, Options and Crypto.#2 Olymp Trade

Olymp Trade is a category A broker of the international Financial Commission. Start trading seamlessly right now.#3 BINOMO

944 168 Traders trade daily. Financial Commission Category A. Sign up and get $1,000 in a demo account.#4 Binary.com

Trade 24/7, even on weekends. Trade Stocks, Forex, Options and Crypto.

Top binary options brokers fact sheet 2026

- Trade binary options with regulated brokers

It’s recommended to trade with license brokers to ensure security for your funds. With a regulated broker, it’s easy to make follow-ups in case of issues such as fraud. Besides, a regulated broker is ready to listen to complains to avoid ruining the reputations

- Reading and understanding the term and conditions

With terms and conditions, you have a foundation from which you can question in case you are overcharged or charged unnecessarily. For instance, there are charges for withdrawal from an account. Sometimes a trader may find that the rate at which the withdrawal was charged was higher than the rate stipulated on the terms and conditions.

- Trade on a demo account

Before risking funds in a real account, it’s important for beginners to practice trading in a demo account. A demo account uses virtual funds and plays a crucial role in enabling a trader to understand trading strategies and how markets operate.

- Customer support

It’s preferable to choose an online broker whom customer care support responds fast and is available for 24 hours a day in a seven-day week. A trader may be in an urgent situation that needs to be addressed immediately.

Comparing Brokers and Platforms

Before registering for the services of any binary broker or online trading platform, you must invest some time and energy in comparing various platforms and brokers. We have created the following check list to help you in this task.

- Minimum Deposit – Compare the minimum amount that traders must deposit at several binary brokers. The minimum deposit amount can be as little as $5 to as much as $250.

- Licensing Information – Find out about the authorities that have licensed various online trading platforms.

- Demo Accounts – Do the online brokers allow traders to open demo accounts? Are the demo accounts available for a life time or only for a limited period of time?

- Free Signals – Does the online trading platform offer any free signals? Or do traders have to subscribe to the signals?

- Mobile Trading – Can you trade on the move or should you rely on your desktop computer?

- Mobile Trading Apps – Do you have to download any mobile trading app or can you trade on your browser?

- First Deposit Bonus – What are the terms and conditions of the bonuses offered by various online trading platforms?

- Trading Tools – What kind of trading tools do various brokers offer?

- Asset Classes – Check the asset lists of various trading platforms. Can you trade on cryptocurrencies, currency pairs, Forex, stocks, and indices?

- Customer Support – Don’t hesitate to contact the customer care representatives just to test their promptness, courteousness, and helpfulness.

5 Tips to Choose a Binary Options Broker

Once you have learned to compare a variety of online trading services, you can sign up at one or several of them.

Here are five tips to help you:

Tip #1: The Deposit Bonus

Everybody loves bonuses, but not all brokers offer them. In fact, very few brokers offer generous bonuses with reasonable terms and conditions. For this reason, you should compare the bonus offers at multiple online brokering services. In most cases, the minimum deposit will be lower when the bonus is bigger. In some cases, the broker may allow traders to deposit a very small amount, but not offer a bonus.

If you are a beginner, you must sign up at a broker with a low minimum deposit. It not only minimizes the risks of trading, but also gives you the time and the opportunity to learn about trading and get comfortable with the online trading platform.

Also, don’t make the mistake of taking a bonus at face value. Bonuses are always associated with terms and conditions. You must read and understand these terms before claiming the bonus.

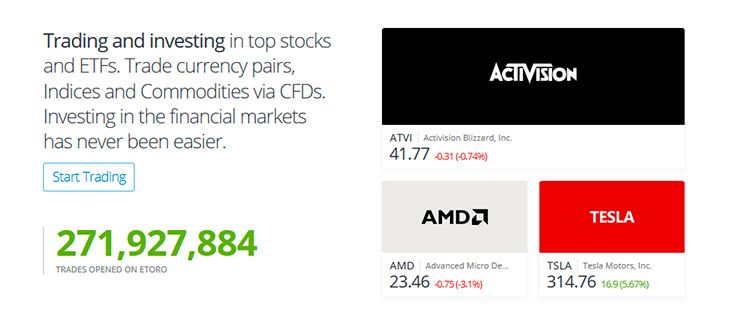

Tip #2: Assets and Trading Instruments

Which asset would you like to invest in? There is no sense in signing up at a platform that doesn’t offer the asset that interests you. For this reason, you should always check the broker’s index of assets.

You should also check the list of trading instruments. Brokers usually offer options such as boundary, touch/no touch, and call/put, but you can also find unusual options such as kiko, range, and pairs.

Tip #3: The Terms and Conditions

Never sign up at a binary options broker without first reading and understanding its terms and conditions page. Undoubtedly, reading the terms and conditions page is an unsavory experience as it is long, complicated, and boring. But you still need to understand what is in the fine print as it truly matters when you start trading on the platform. You should especially read the part that deals with making deposits and withdrawals and check for fees charged and restrictions.

Tip #4: The Customer Support

Avoid registering for the services of an online brokering service that doesn’t offer adequate customer support. Ideally, customer support must be available 24 hours a day and seven days per week through email, phone, and live chat. The online trading site must also mention its physical address clearly. Test the customer support service by calling them up or sending them an email just to test the promptness of the response and the courteousness of the customer care agents.

Tip #5: Industry Experience

The trustworthiness of an online trading platform increases with its number of years in service. Spend some time studying the history of an online broker. Try to identify the date of establishment. New services may vanish after a few days with its customers’ deposits, but a company that has been in business for several years is least likely to do so. You may also notice that new brokers offer bigger first deposit bonuses to lure customers while the established ones don’t.

A Word on Regulation and Why It Matters

Trading binary options is legal in several countries such as the US, the UK, Australia, New Zealand, Cyprus, Japan, and Malta. You can safely and legally trade as long as your broker is licensed and regulated for the following reasons:

- Licensing bodies oversee the activities of online trading services.

- They work in the best interests of traders.

- Through their regulatory frameworks, they protect traders and ensure that they get fair market prices.

- They also ensure that brokers do not delay in paying out traders’ profits.

- They require brokering companies to maintain trader deposits separately from operational funds so that traders can get a refund in case the company shuts down.

- They protect traders from fraud on the part of binary brokers.

If you trade at a licensed online trading service, your best interests are taken care of.

Your funds and personal information are protected. You can rest assured of quick payouts and refunds in case the company goes out of service. You can also expect quick and impartial resolution of your disputes with the broker.

Here is a list of licensing bodies in various countries:

- The US has strict financial laws. It has two regulatory bodies to oversee its trading market—the US Securities and Exchange (SEC) and the US Commodity Futures Trading Commission (CFTC).

- In the UK, online brokers can be trusted if they operate under a license granted by an authority that the UK Financial Conduct Authority (FCA) trusts.

- In Australia, online trading is regulated by the Australian Securities and Investments Commissions (ASIC).

- In New Zealand, the regulatory body is the Financial Markets Authority (FMA).

- Japan has two regulatory agencies, the Financial Services Agency (FSA) and the Securities and Exchange Surveillance Commission (SESC).

- The Cyprus Securities and Exchanges Commission (CySec) has licensed some of the finest online trading services in the industry.

- Malta has also legalized financial trading and grants licenses through the Maltese Financial Services Authority (MFSA).

Even if you reside in a grey jurisdiction, you may safely and securely trade at online trading services that have received a license in Malta or Cyprus.

TOP 2 Regulated Binary Brokers in 2026

We have identified the following as the top two regulated binary brokers in 2026:

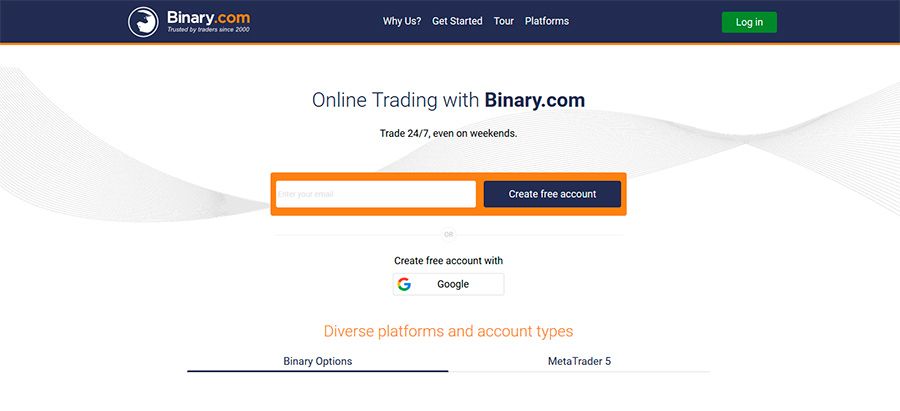

Binary.com

Is an award-winning online broker who allows trading in all major indices, commodities, and currencies. So far, it has handled trades worth over two billion dollars. Successful traders at Binary.com can withdraw their profits in the range of $1 to $50,000. Launched in 2000, Binary.com caters to traders from several parts of the world. It operates under a license granted in the British Isles and in Malta. The major selling points of the trading platform are excellent customer support, a user-friendly interface, and patented pricing technology.

24 Option

24Option is a web-based online trading platform that is very easy to navigate and use. Registered traders can choose from a wide range of assets to trade on. They can download native apps for Android and iOS to trade on the move. The company also offers the MT4 platform, which delivers a better trading experience. Customer service is available through live chat, phone and email.

The above-mentioned are just brief overviews. You can read exhaustive reviews of these binary brokers on our website before registering an account at these services.

Should You Use Multiple Brokers?

The concept of trading with multiple brokers is new, but fast gaining popularity. The advantages of registering for the services of multiple online trading platforms are many.

- Protect Your Investment – When you use the services of multiple brokers, you can reduce risks by spreading out your investments. You don’t have to risk all your money with one broker. If your experience with one broker is bad, you can always expect a better experience with the other broker.

- Get the Best Deals – Different brokers offer different features and deals. Two brokers may offer a different set of investment options. If you sign up at multiple brokers, you can enjoy the benefits of multiple deals. Also, you can avail of several investment options.

Signing up at multiple brokers, therefore, is one of the best trading strategies a serious trader can use.

Frequently Asked Questions

Which is the best binary options broker for a beginner?

To reduce trading risks, choose a broker with a low minimum deposit. You will have time and a chance to understand trading well. The lowest minimum deposit amount for some brokers is usually 5 dollars. Sometimes you may find the broker is offering a bonus. Be cautious to only to take the bonus after fully understanding the terms and conditions.

Which asset should I buy?

You need to know the asset you wish to trade before you sign up on any platform. The asset could be stocks, currency pairs, indices, cryptocurrencies etc. Ensure the broker you choose has the asset that you want to trade.

Is trading binary options legal?

It depends on the country. Countries that have legalized trading of binary options are New Zealand, United States, United Kingdom, Japan, Malta and Cyprus.

Is it good to trade with many brokers?

Yes. Having several trading platforms is ideal. At least if one broker is inconvenient, there is still another where you can continue with your trading. Besides, brokers have different features and investment options thus you can benefit from a variety of deals.

Who regulates brokers in the UK?

Any authority whose United Kingdom Financial conduct authority (FCA) has confidence on can give license to brokers.

Which binary broker should I choose?

According to 2026 regulated brokers, the top two are Binary.com and 24Option. Binary.com offers exceptional customer care. Besides, the pricing expertise is patented in addition to an interface that is convenient for its users. 24Option which comes plenty of assets to trade is easy to use and customer support can be accessed through email, live chat, and phone.

Can I trade binary options when 15 years old?

An online broker requires you to provide personal credentials in order to prove your age, home address and identity.

What should I consider when choosing an online broker?

• Read the term and conditions before accepting any bonus. • Examine the convenience of the user interface. An interface that is convenient and user friendly is the best. • Check the efficiency of customer support • Ensure the broker has the asset you want to trade. • Assess the history of the broker. An online broker that has been there for several years is preferable. • Read all terms and conditions before registering with a broker • Examine withdrawal and deposits. Check the procedures and if there are charges.

Conclusion

So now that you know a lot about choosing the best broker to trade binary options, what are you waiting for? We strongly suggest signing up at Binary.com or IQ Option. Both brokers allow you to open a demo account for free. You can learn the secrets and strategies of trading without risking your hard-earned money.

These companies also educate and inform new as well as seasoned traders by offering a wide range of educational material such as training videos, webinars, articles, blog posts, eBooks, and others. If you sign up at IQ Option or Binary.com or any other platforms we recommend, you can not only trade, but also learn more about trading.