Planning is essential for success and Forex trading is no exception to this rule. If you want to succeed at Forex trading, you must create a proper trading plan. These plans, also known as Forex strategies, are available in plenty.

Successful Forex traders must understand the pros and cons of various trading strategies. They should never trust a strategy blindly and follow it to the letter. For example, there are strategies that promise huge profits in the shortest possible time. Strategies such as these cannot be trusted.

This page serves as a guide to help you find a Forex strategy that best suits your requirements.

How to Choose the Best Forex Strategy

Before choosing a Forex strategy, traders should get familiar with the four main varieties of trading:

- Position Trading – Position traders are traders who hold their trades for a long period of time, usually for several months. Since they have to analyze the market deeply at the fundamental level, they usually use fundamental Forex strategies.

- Swing Trading – Swing traders are traders who hold on to their trades for up to several weeks. By doing so, they have to risk overnight changes in market conditions, but they can aim at larger profits because of the longer term of their trade. They usually use a mixture of fundamental and technical Forex strategies.

- Day Trading – Day traders are traders who open and close trades in the course of one trading day. They use technical analyses on shorter time frames that range from 15 minutes to 60 minutes.

- Scalping – Scalpers like to trade at breakneck speeds. Since they sometimes hold trades for only a few seconds, they can open multiple trades every day. Their aim is to generate profits on smaller price movements and the profits they make are very small. They depend a lot on news trading and technical analysis.

Types of Forex Trading Strategies

The following are the important types of Forex strategies that are popular among traders:

Technical Forex Trading Strategies

These are strategies based on technical analysis, heavily relying on analysis of price data and price charts. Traders can use these strategies on trades of varying time frames. Strategies based on technical analysis can help traders generate profits, provided the trader does the market analysis properly.

Here are a couple of technical strategies:

- Trend Trading – The trader rides on a trend as long as he/she can profit from it. However, identifying the beginning and end of a trend is not an easy task, which makes this type of trading rather risky. Traders can trade trends on different time frames, ranging from five-minute to four-hour charts.

- Range Trading – Range traders identify ranges in a chart and make trades within this range. They assume that history repeats itself when it comes to price movements.

Fundamental Forex Trading Strategies

These are strategies based on analysis of market fundamentals, which include financial growth, changes in financial policies, rates of inflation, interest, and poverty, and so on.

When compared to technical analysis, fundamental analysis is more complex, requiring traders to correctly analyze the financial news from multiple sources and eliminate insignificant events. Strategies based on fundamental analysis best serve swing traders although day traders too use them sometimes as they know that breaking financial news can create waves in the market.

Here are a couple of fundamental strategies:

- Carry Trade – The aim of the carry trader is to profit by trading on currencies with different rates of interest. Although it not as exciting as day trading, carry trading fetches sure profits in the long term.

- News Trading – The human news trader is now facing stiff competition from robots or automated systems that are capable of processing multiple news reports in a fraction of a second. Traders who are good at absorbing multiple news reports in the shortest possible time can trade on major movements in the financial market and make a profit out of it.

Trend Following Forex Strategies

Trend following Forex strategies enjoy a great deal of popularity among Forex traders as they are known to work. These are strategies that aim at using long-term market trends to the trader’s advantage. They try to benefit from either side of the financial market, profiting from the ups as well as the downs.

Traders employing these strategies use channel breakouts, moving averages, and market price calculations to find out the direction in which the financial market is moving. They are more interested in riding market trends than in making predictions.

Traders can use price action techniques to determine whether there are downtrends or up trends in a market. In addition, they can use technical indicators to identify and measure the strength of various trends.

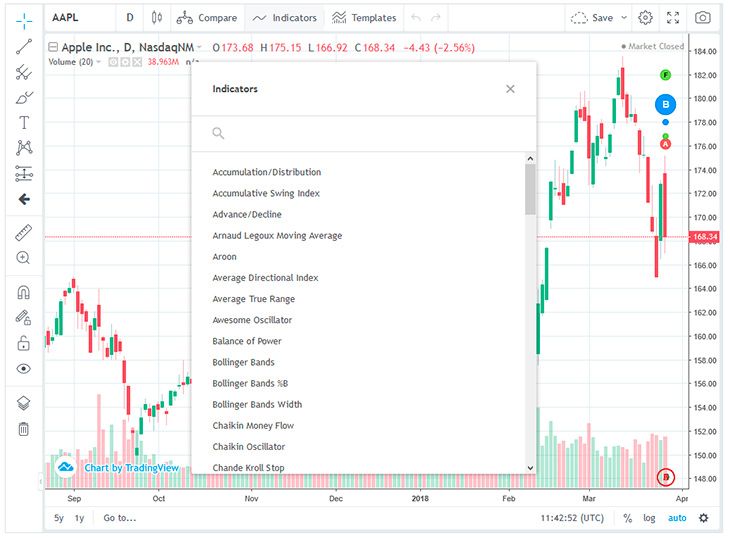

For example, if the average directional movement index, which happens to be one such technical indicator, shows a value ranging from 25 to 50, it indicates strong market trends. Values in the range of 50 to 75 indicate very strong market trends, and values exceeding 75 indicate extremely strong market trends.

Breakout Forex Strategies

Day traders prefer using these strategies as the momentum of the financial market increases after major breakouts at the technical levels, especially at the resistance and support levels, channels, trend lines, and chart patterns. When traders use these breakouts in a proper manner, they can generate huge profits.

For example, chart patterns are very popular among traders using breakout strategies as they are capable of indicating whether an existing trend will continue or reverse.

Countertrend Forex Trading Strategies

Traders who follow these strategies open trades that move in a direction opposite to that of the primary trend. The aim is to trade on price corrections following powerful down moves and up moves. While this can lead to the generation of huge profits, it can also cause huge losses.

Choosing the Best Forex Trading Strategy – Tips for Beginners

So now that you have learned a lot about various strategies and different types of trading, you have to choose the best Forex trading strategy as it is essential for your success.

Here are a few tips that will help you with your selection:

# Tip 1 – Choose the Best Online Forex Trading Platform

You may choose the best trading strategy, but if you want it to really work, you should also choose the best online Forex trading platform.

There are several Forex brokers and online trading platforms in the industry, but not all of them are to be trusted. If traders are not careful enough, they may end up signing up at a scam site or a platform that is incapable of providing accurate quotes. Some platforms may also show ads that have nothing to do with trading, which may impact their performance.

Traders should first identify and register at online Forex trading platform or broker that is capable of providing excellent security, accurate quotes, trading tools, and other features. It should not only have an interface that is user friendly, but also allow new traders to create a demo account for free.

# Tip 2 – Use Several Strategies

Different strategies work differently for different strategies. At the same time, the same strategy works differently in different market situations. Traders have to analyze their strong and weak points when it comes to trading. They must also determine whether they want to make short-term or long-term trades. Also, they should be willing to change their trading styles to suit movements and trends in the market.

The following are some strategies that have worked for traders for several years:

- Daily Fibonacci Pivot Trade – Although the strategy focuses only on daily pivots, traders can adjust it for longer term trades. A combination of Fibonacci extensions and retracements, this strategy is capable of including multiple pivots.

- Bladerunner Trade – Traders can use this strategy for all currency pairs and time frames, which makes it one of the most popular Forex trading strategies at present.

- Overlapping Fibonacci Trade – Though not as reliable as other strategies, traders can use it to their advantage by combining it with appropriate signals.

- Bolly Band Bounce Trade – If traders use this strategy in combination with a confirming signal, they can really generate profits.

- Pop ‘n’ Stop Trade – This strategy teaches traders how to effectively chase prices when they go upside. Traders who implement it can easily find out if prices will continue to fall or rise.

While testing several strategies to determine the effectiveness of each is essential, traders should not jump from one strategy to the other without first testing it thoroughly and getting comfortable with it. Stick to a strategy for as long as you can. Test it on a demo account, and if it works for you, use it on a real money account. Once you have learned everything about using that strategy to your advantage, you can explore other strategies. You can also experiment on multiple strategies on multiple accounts.

# Tip 3 – Learn the Art of Trading without Emotion

Not even the best strategy can work for you if you get too emotional about your wins and losses while trading. Traders should neither get upset when they lose their trades nor become overconfident when they generate more than the expected profits.

Most beginners make the mistake of chasing their losses. They also make the mistake of getting too greedy if they win. To put it very simply, you cannot become a successful trader if you get carried away by your emotions. You must remain calm and collected irrespective of your trading results.

# Tip 4 – Never Stop Educating Yourself

The top trading platforms in the industry offer excellent resources in the form of high-quality articles, webinars, short-term and long-term trading courses designed for beginners, intermediates, and experts in trading, eBook, and others to inform and educate traders. The best traders use these resources to improve their knowledge and better their strategies. As far as Forex trading is concerned, you can never stop educating yourself.

Conclusion – Developing a Trading Plan

When you have selected a Forex trading strategy, you must develop a foolproof trading plan. Choosing a trading strategy is just the beginning of developing a trading plan. In fact, a proper trading plan incorporates effective trading strategies, money management techniques, risk management techniques, determining the best time for trading, and many other factors that result in a successful trade. While creating your trading plan, you should also consider factors such as your style of trading and your personality.

Once you create a proper trading plan, you must test it on a demo account so that you can carefully analyze the results it produces in different market conditions. This gives you enough confidence and experience to use the same strategy while investing real money on trades.