The concept of trading currencies in pairs sets the Forex (FX) market in a class of its own. Trading currencies are therefore quite different from trading any other asset class.

When you trade currencies, you are exposed to not one currency, but a pair of currencies. While this presents a number of lucrative opportunities, it also requires the development of special skills on the part of the trader. One of these skills is the ability to measure the strength or weakness of various currencies.

Since currencies are traded in pairs, it becomes very difficult for the trader, especially the beginner, to gauge the performance of just one of those currencies. For example, if you learn than EUR/USD is gaining fast, you may find it difficult to determine whether the pair is gaining because of the strength of the Euro or the US Dollar.

But there is a solution to this difficult problem of measuring currency strength and weakness, and this solution comes in the form of an online Forex indicator that goes under the name of currency strength meter.

- Currency Strength Meter – Know the Basics

- Reasons to Use Currency Strength Meters

- Disadvantages of Currency Strength Meters

- Importance of Correlation in Calculating Currency Strength

- Downloading and Using the Currency Strength Meter

- Tips to Use the Currency Meter

- How to Create Your Own Currency Strength Meter

- Currency Strength FAQs

- Conclusion: Tips to Become a Successful Forex Trader

Currency Strength Meter – Know the Basics

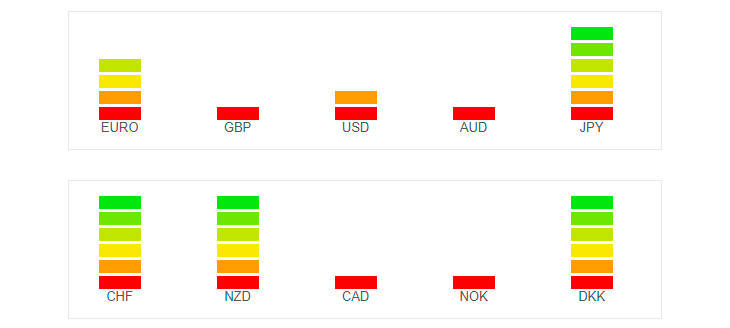

Currency strength meters also go under the name of currency strength indicators. To put it very simply, they are visuals that depict the strength and weakness of the major currencies of the world.

How do they do this? They take into consideration the exchange rates of various pairs of currencies to create an aggregate and comparable strength for each currency.

No two currency strength meters are alike. While some of them are so simple that they do not consider any weighting, some are advanced tools that use their own weightings. Some currency strength meters or indicators use permutations and combinations of other indicators along with measurements of currency strength or weakness to create their own trading signals.

Let us try to illustrate the working of a currency strength meter with a simple example.

Consider, for example, that you would like to know how strong the USD is at present. Your currency strength meter will first calculate the strength of all currency pairs that contain the USD. It will then put the results together to determine the strength of the USD.

Currency strength meters may also use more comprehensive, but little known measures such as the broad USD index, which incorporates a wide range of currencies. These tools also calculate the strength of all currency pairs containing the US Dollar and then pool those calculations to get a single number. Then they apply weightings for all the currencies. The weighting applied to the broad USD index is obtained from a large body of trading data.

Reasons to Use Currency Strength Meters

So what are the various advantages of using Forex currency strength meters or indicators?

In the first place, currency strength meters are simple tools that are very easy to use. As a short-term indicator, it is invaluable. It has the ability to protect traders from needless hedging and double exposure. Also, it can determine the risk level of the trades you have just entered.

However, its biggest advantage is that it is available free of charge although you have to pay to get hold of the more complex currency strength meters in the industry.

The following are the details:

- Useful Indicators for Short Term Trading: Professional FX traders usually use currency strength meters as indicators for short-term trading as they quickly guide traders to currencies that are gaining. Since they present an accurate picture of the current strength of a currency, they become very useful for short-term FX traders. Some traders also use them to verify the data they obtained from other indicators.

- Easy to Use: Currency strength meters are very easy to understand and use. They are more popular among new FX traders for this reason. Even if you are not a market expert and still have tons to learn, you can easily understand FX currency strength meters as they are simple visual displays that tell you exactly which currencies are doing well and which are underperforming.

- Free of Charge: As previously mentioned, you will have to pay for sophisticated currency strength indicators that use complex data to deliver accurate trading signals. But most of the simplest and most effective currency strength indicators are available absolutely free of charge.

Both MetaTrader 4 and MetaTrader 5, the most well-known and the most used trading platforms in the world, offer free currency strength meter plugins that you can easily download and use. To get your plugin, you have to first create an online brokerage account and download the trading platform on your computer.

You can then download indicator packages, which include multiple indicators. One of those indicators will be the currency strength meter, which allows you to view and compare the strength and weakness of various pairs of currencies.

In addition to a free currency strength indicator, you will also find other free trading tools such as free trading signals, technical insights, global market sentiment widgets, mini trading terminals, and much more. And all this is available absolutely free of charge.

- Protection from Double Exposure: Since high correlation assets move in the same direction, you will end up overtrading if you enter multiple trades on highly correlated pairs. In such a case, you will lose a lot of money if the market refuses to move in your favor. For example, you will be at risk of double exposure if you go long on currency pairs such as AUD/JPY, EUR/JPY, and AUD/CHF if these pairs are highly correlated.

You will gain double exposure to JPY and AUD, which will lead to a huge loss for you if the market moves in a direction opposite to the one you predicted. A Forex currency strength indicator will protect you from such exposure because it gives you a simple graphic presentation of highly correlated currencies. You can, therefore, easily avoid trading these currencies and protect yourself from the risk of getting double exposed to weak currencies.

- Prevents Needless Hedging: Traders can easily avoid needless hedging if they know in advance about the correlation between various pairs of currencies. Consider, for example, the currency pairs USD/CHF and EUR/USD have negative correlation.

When you know in advance of the negative correlation between these pairs of currencies, you will know that the market movement of these currency pairs is in opposite directions. So if you long trade both these pairs, you will lose one of the trades although you will win another. In this way, currency strength meters save you from needless hedging.

- Identify High Risk Trades: Currency strength meters can also help you identify the risk level of the trade you just entered. Consider, for example, that you are planning on going long on the currency pairs GBP/USD and EUR/USD. There is a positive correlation between these currency pairs, indicating double risk if the strength of one of the currencies is stronger.

There is also another possibility. One of the currency pairs may indicate a strong market movement while the other may indicate ranging. This is a clear signal to traders to avoid trading correlated pairs with opposing market movements.

For instance, if GBP/USD is ranging and EUR/USD is fast falling, you should not go long on the former as this pair is strongly associated with the risk of falling because the USD could be stronger.

Disadvantages of Currency Strength Meters

Despite their benefits, currency strength meters are not the best of FX trading indicators. A poorly coded currency strength meter can generate a number of issues.

If you have found a currency strength indicator that does not give you the accurate strength value of a currency, you just won’t be able to make a successful trade. An outdated or badly coded currency strength indicator can lead to freezing, wrong signals, memory leakage, stutters, and the CPU constantly working at 100 percent.

Some of them might just not function the way a proper currency strength meter is supposed to. Some of them use additional filters such as MACD, RSI, and moving averages as a result of which, they generate the wrong signals. If traders trust these signals, they will end up entering the wrong trades at the wrong time and losing a lot of money.

The most important point to understand is that currency strength indicators give you a small piece of information. You have to take that piece of information about the strength or weakness of a currency and see how it fits in the larger picture.

Find out if there is anything that supports the story the currency strength meter is trying to tell you. Ascertain if the currency meter is giving you the accurate information.

Putting it in brief, you have to understand that the currency strength meter is nothing but a technical tool, which has to be used along with a number of other tools. It is best used to either confirm or complement the information other indictors and trading tools are trying to give you.

Importance of Correlation in Calculating Currency Strength

Currency correlation plays an important role in giving you the correct measure of a currency’s strength. You will not come across any of the issues mentioned above if you find a currency strength meter that has been coded with the help of the latest trading technologies.

In fact, correlation is so important that the latest currency strength meters are actually currency correlation matrices capable of delivering accurate and complex data. Correlation simply points out the correlation between the currencies in a pair. To put it in financial terminology, correlation gives the numerical measure of the relationship of two currencies. The correlation co-efficient is always in the range of -1 to +1.

If the correlation of a pair of currencies is +1, it indicates that the market movement of both currencies will be in the same direction. If the correlation of a pair of currencies is -1, it indicates that the market movement of both currencies will be in the opposite direction. A zero correlation indicates arbitrary relationship between the two currencies.

High correlation currency pairs are always strongly linked together. Positive correlation currency pairs exhibit market movements in the same direction, and negative correlation currency pairs exhibit market movements in opposite directions.

But how is correlation used to calculate the strength of a currency?

Correlation can be used to measure currency strength because we trade currencies in pairs. Consider, for example, that the correlation of GBP/USD and EUR/GBP is -91. This indicates negative correlation. The market movement of the two pairs is most likely to be in opposite directions.

If you trade long on these pairs or even if you trade short term, your losses will cancel out your profits. To explain this further, you will be hoping to profit on the fall of the GBP if you trade long on EUR/GBP. On the other hand, you will be hoping to profit on the rise of the GBP if you trade long on GBP/USD.

Owing to the high correlation between the two pairs, we can calculate that the currency that is common to both these pairs, GBP, is the strongest currency.

Downloading and Using the Currency Strength Meter

When it comes to downloading currency strength meters, you have a wide choice ahead of you. Some of the best currency strength meters in the industry come at a price, while others are absolutely free of charge. While some are standalone applications, others are MT4 expert advisors. You will also find quite a few web-based currency strength meters.

A lot of them will give you inaccurate data. In fact, most of them will not perform as expected. Some of them will freeze and behave in an unreliable manner.

But you will find plenty of reliable and effective currency strength meters on the MetaTrader4 and MetaTrader5 platforms. Also referred to as MT4 and MT5 platforms, both are the most popular online Forex trading platforms in the world. MetaTrader 4 is an open trading platform with a huge community of traders, and you can search for paid as well as free custom indicators on this platform.

The biggest benefit of these platforms is that they enable traders to download custom indicators along with expert advisors (EAs), absolutely free of charge. Both platforms feature selections of trading tools and indicators incorporated into the terminals of individual online brokers. At the same time, they also allow traders to independently download indicators customized for their trading styles, philosophies, and needs.

Downloading a currency strength meter is as simple as following these steps:

- Find a broker and create an online brokerage account.

- You can either create a free demo account or a live trading account.

- Use the download links on the broker’s website to download either the MT4 or the MT5 platform.

- Launch MT4 or MT5 on your computer and login to your online brokerage account.

- Navigate to Expert Advisors and choose currency strength meter from the set of tools displayed.

To use the indicator, you only have to drag it to a previously opened currency chart. Set your parameters using the window that pops up on your screen. Then click on the OK button to view the results.

The MT4 currency strength meter is extremely user friendly although it uses a set of complicated algorithms. You can choose to calculate currency strength within a given time frame.

Tips to Use the Currency Meter

Using the currency strength meter to boost your trades is a work of art. You must understand that currency correlations are constantly changing. You cannot use a currency’s previous performance as an indicator to predict its correlations in the future. But as an expert FX trader, you can use this valuable information to create an effective FX trading strategy and minimize the risk to which your trading portfolio is exposed.

Here are some tips that help you use the currency strength meter better:

- Avoid Entering Trades that Neutralize Each Other: Avoid going long on two pairs of currency that are clearly moving in opposite market directions. Your loss on one of these trades will definitely nullify your profits on the other.

- Minimize Risks:When you invest in two pairs of currencies with positive correlation, you can easily minimize your risks.

- Minimize Losses:At the same time, you can minimize your losses if you hedge two pairs of currencies with a negative correlation that is close to perfect. If you trade a pair of currencies that is losing value, the pair that is in negative correlation to it is sure to gain. You won’t be eliminating losses if you use such strategies, but you will definitely be minimizing your losses.

While using the currency strength meter, avoid the following mistakes:

- Don’t Use It Without Knowing How It Works: The biggest mistake that beginners to FX trading make is using currency strength meters without knowing how they work. Like all other trading indicators, currency strength meters function on the basis of a formula, which helps it determine the weakness or strength of currencies. You can trust the currency strength meter and the information it reveals only if you thoroughly understand this formula.

Several things can go wrong with a currency strength formula. The formula that governs it could be all wrong. Or it could be coded to function only on daily timeframes, and you could be unknowingly using it on lower timeframes.

Irrespective of the trading tool or technical indicator you choose to use, you should use it only if you know and understand the formula on which it works.

- Don’t Time Trade Entries on the Basis of Currency Strength Meters: Avoid blindly exiting and entering trades based on the information the currency strength meter gives you. For example, you use the currency strength meter to find out the strongest pairs of currencies at present and make a quick buy. You think that the currencies will get stronger.

In this case, you are making a big mistake. Currency strength indicators are meant only to inform you about the strength and weakness of currencies within a particular time frame. This is, by no means, a signal for you to enter or exit a trade.

If you make this mistake, you will be chasing markets that have already moved a lot. You cannot place an effective stop loss, and the chances of you being exited from a trade are high when the prices drop.

- False Signals are Usually Sent on the Lower Timeframe: Currency strength meters calculate price change within a given time frame to determine the strength or weakness of currencies. When done on the lower timeframe, it leads to the wrong signals.

This is because important breaking news can lead to a sudden rise in price, which currency strength meters use to calculate the strength/weakness of a pair of currencies. For this reason, you should always use currency strength meters that calculate price change from higher timeframes.

How to Create Your Own Currency Strength Meter

If you are unable to trust the currency strength meters in the industry, you can create your own currency strength meter. All currency strength meters calculate price changes within a given time frame and use them to determine the strongest and weakest pairs of currencies. You can add to your currency strength meter more formulae and weighting.

The simplest currency strength meter, however, does not require any complicated algorithms and formulae.

- Step #1: You have to first make a list of major pairs of currencies.

- Step #2: Your next step is to calculate the changes in percentage during the last 15 weeks.

To do this, you just have to insert the rate of change (ROC) indicator into the weekly time frame and change its settings to a 15-week period.

- Step #3: Finally, you have to rank the currencies from the strongest currency to the weakest currency. You would be placing the pair getting the highest value right at the top, followed by the pair with the next highest value, and so on.

Currency Strength FAQs

Here is a selection of some of the commonly asked questions about currency strength:

Q1: What are the various factors that determine the strength of a currency?

A: According to a Forbes article, three crucial factors determine the strength of a currency.

Rates of Interest: High rates of interest contribute to the strength of a currency. They encourage foreigners to invest in that currency in the hopes of getting higher returns.

Financial Policies: Strong economic policies lead to the creation of a strong currency.

Stable Government: Investors are attracted to countries with a strong and stable government, and this increases the strength of a currency.

Q2: How do you know when currencies are weak or strong?

A: Currencies are strong when their value increases in relation to the currency of another country. Currencies are weak when their value decreases in relation to the currency of another country.

Q3: What are the disadvantages of weak currencies?

A: A weak currency leads to expensive imports and rise in the cost of production of businesses that rely on imported goods. When this happens, there is inflation. A weak currency also leads to increase in export profits, resulting in higher costs and inflation.

Q4: Why do countries devalue their currency?

A: Countries can devalue their currency to achieve their economic goals. Weaker currencies result in a boost in exports, reduction in trade deficits, and reduction in rate of interest on government debts.

Q5: Which is the best time for currency trading?

A: The Forex market is open 24/7, but the best time to trade depends on individual trading goals, styles, and philosophies. However, trading at the wrong time can lead to huge losses. According to most Forex experts, the best time for Forex trading is the late Asian or US trading sessions or the early European trading sessions.

Conclusion: Tips to Become a Successful Forex Trader

Forex trading is easily accessible, challenging, exciting, and presents several opportunities for growth. Many FX traders fail to become successful because they do not emphasize on learning and growth. A lot of people end up losing their entire capital on Forex trading because they just don’t know enough about FX trading.

However, everybody has an equal chance to succeed in the Forex market, and here is how you can become a FX success story.

- Your Goals Should Be Clear: You should not only know exactly what you want, but also be realistic about it. Set small, bite-sized, and realistic trading goals such as achieving 10 – 20 percent returns on your trading capital every year, earning up to US$5000 in profits, and so on. Preferably, you should set long-term goals that you have a high chance of achieving.

- You Should Know Your Resources: The next step is to ask yourself if you have the required resources to achieve your goals. Do you have a trading capital that is large enough? Do you have enough time for trading? Are you willing to invest extra funds on purchasing trading tools and software? Are you willing to spend on your trading education?

- Create an Effective Trading Plan that You Can Follow: Your trading plan includes rules that govern your trades, the amount you are willing to bet, and the number of trades you will exit and/or enter and so on. And once you make a plan, you shouldn’t deviate from it no matter what.

- Beware of Wrong Trading Habits: A number of traders end up unknowingly developing the wrong trading habits, especially during the initial phases of their career. Many of them start overtrading in the hopes of making a bigger profit. This happens when traders get lucky and go on trading till they have wiped out their capital.

Another wrong habit that traders develop is relying entirely on luck. Trading becomes equal to playing the lotteries if you rely entirely on luck. Luck does have a role to play in a trader’s success. However, relying on luck alone and never on market research and technical analysis will quickly lead to your downfall.

- Never Stop Learning: As a Forex trader thirsting for success, you just cannot afford to stop learning. Since the market is continuously changing, you have to stay updated enough to feel its pulse and understand its ups and downs.

Fortunately, you don’t have to spend a lot on your education. Most top-rated online FX brokers educate and train their customers free of charge. You will find plenty of educational material in the form of webinars, articles, electronic courses, eBooks, video tutorials, and others at the best online brokers in the industry.

You should be able to read, analyze, and discuss indexes, charts, and ratios with ease. Take your time to get educated as you cannot rush through it. To become a successful FX trader, you need to learn and research as much as you possibly can. You should be willing to put in hundreds and thousands of hours just in studying the markets. Don’t ever make the mistake of trading FX without undergoing the required training.

- Find a Good Online Broker: When you are ready to start trading, you should find a good broker. There are plenty of brokers in the industry, which is why you should take as much time as you need to identify one that can best help you to meet your trading goals. Research the broker well to ascertain that the company is financially fit, licensed, and reputed.

The best broker is not the one who makes tall promises. Instead, the best broker is the one that is capable of helping you achieve trading success. It is a licensed online FX trading service that protects and insures client funds, offers round-the-clock customer support, trains and educates beginners, and offers sophisticated trading platforms and trading tools.

- Start with a Demo Account: While it is highly advisable to get started with a demo account, you should avoid staying on a demo account for an indefinite period of time.

If you want to become a successful trader, you have to make profits. And live trading is the only way to make profits. So you just cannot afford to stay on a demo account for too long a time. Sooner or later, you must plunge into live trading, and the ideal time to do so is after 2 – 3 months of practicing on a demo account.