User Review

( votes)Summary

ICMarkets is one of the biggest true ECN forex brokers in the world. Its true ECN environment offers spreads starting from 0.0 pips, no price manipulation, no requotes, and no restrictions. For this reason, ICMarkets has a number of robots, scalpers, and high-volume traders in its trading community.

Pros

• True ECN trading environment

• Spreads start from 0.0 pips

• Trade size ranging from 1 micro lot to 250 lots

• Excellent 24/5 customer support

• State-of-the-art trading tools

Cons

• No bonuses or promotions

The following are some of the selling points of ICMarkets:

- Fast Trade Order Execution – The average execution speed at the FX broker is less than 40ms.

- Automated Traders – IC Markets is very popular among automated traders. Its New York based order matching engine processes more than 500,000 trades per day. More than two third of these trades come from automated traders.

- Institutional Grade Liquidity – The broker offers interbank liquidity comprising as many as 50 sources of liquidity. It processes FX trades worth more than US$1.5 billion every day.

- Wide Range of Markets – Trade forex (60 products), commodities (19 products), stocks (120 products), bonds (5 products), and indices (17 products).

- Facts and Figures – The online broker is home to more than 60,000 active clients from different parts of the world. According to the Finance Magnates Q1 and Q2 2017 Intelligence report IC Markets is the world’s biggest FX broker by FX volume.

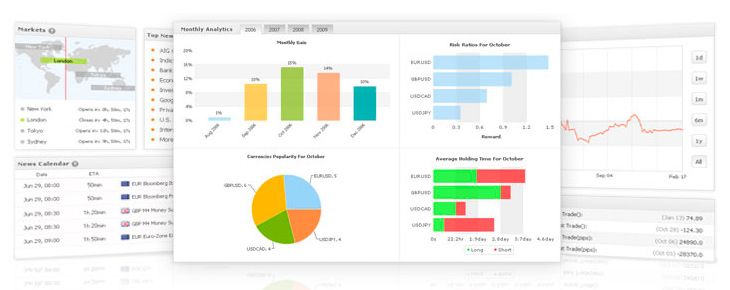

- Superior Technology – The online FX broker has partnered with some of the top trading technology companies in the world to deliver the best trading tools. Some of these tools are inbuilt spread monitoring, automated closure of trades with customized templates, ladder trading, and dept of market (DoM).

- Fact sheet IC Markets 2025

- Is ICMarkets Reliable Broker?

- Guide to Opening a Demo Account

- Types of Accounts

- Get Free Forex Education at ICMarkets

- Assets for Trading

- Choose Your Platform

- Myfxbook AutoTrade for Copy Traders

- Guide to Making Deposits

- Frequently Asked Questions

- Is IC Markets scam?

- Is the IC Market regulated?

- What is the minimum deposit in the IC Market?

- How do I withdraw money from my trading account?

- How long does it take to withdraw?

- Can I transfer my funds between accounts?

- Does the IC Market offer deposit bonuses?

- Can I use the IC Markets platform while in the US?

- What is the raw spread in IC Markets?

- What should I do if my account is hacked?

- What leverage does IC Markets offer?

- ICMarkets – Overall Rating

Fact sheet IC Markets 2025

- Reputable

The company has scooped some of the prestigious awards such as Best Overall Broker 2020 and Best Trading App 2020. This has been attributed to its efficient delivery of services in the brokerage Market.

- High-quality trading platforms

As a trader, you have no reason to worry about the trading platforms. IC Markets offer you three quality trading platforms namely; meta trader 4, meta trader 5, and C trader.

- Excellent customer support

They offer their clients with multilingual support for 24 hours in five days a week. You can access their services via live chat, email, or through their global telephone support hotline.

- Good profits because of the low spread

IC Markets offer low spreads. Every trader knows the importance of low spreads. This makes sure your profit is not eroded by high trading costs.

- Responsive mobile application

The mobile trading platform is user friendly and highly responsive. You are guaranteed of getting a super awesome user experience.

- A wide range of trading assets

IC Markets spoil you with choices. The brokerage offers you over trading instruments. This includes currency pairs, CFDs on indices, stocks, commodities and futures, precious metals, and even the most popular cryptocurrencies.

Is ICMarkets Reliable Broker?

IC Markets is a regulated online FX broker. It is regulated and authorized by the Australian Securities and Investments Commission (ASIC). This financial regulatory body requires its license holders to implement strict staff training and risk management procedures.

Here are the benefits of trading on IC Markets’ regulated platform:

- Based in Australia

- Maintains trader funds in separate accounts at Australian banks such as National Australia Bank (NAB) and Westpac Banking Corporation (Westpac)

- Externally audited

- Member of FOX, an external dispute resolution scheme

- Maintains professional indemnity insurance with Lloyds of London

- Anti money laundering policies in compliance with Australia’s Anti Money Laundering and Counter Terrorism Financial Act (2006)

- Operates on an Australian financial services license

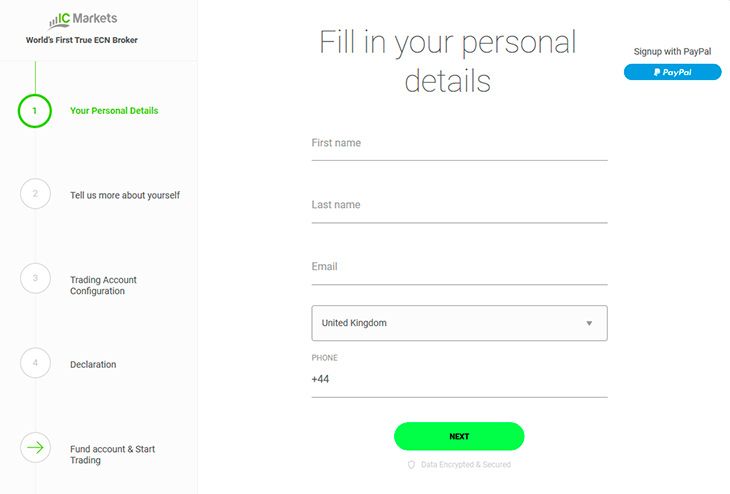

Guide to Opening a Demo Account

New clients can open a demo account instantly at IC Markets. All they have to do is click on the “Try A Free Demo” option on the homepage. When they do so, they will be directed to an online registration form. They have to fill in the required details in order to open an account.

A demo account gives new and hesitant users a risk-free opportunity to practice trading till they are ready to open a live account.

Traders can open a demo account for all types of accounts at IC Markets. Demo accounts also support all the products and trading platforms at the online FX broker.

Types of Accounts

The company has designed a number of account types to meet the requirements of different types of customers and different trading styles.

You can choose from the following:

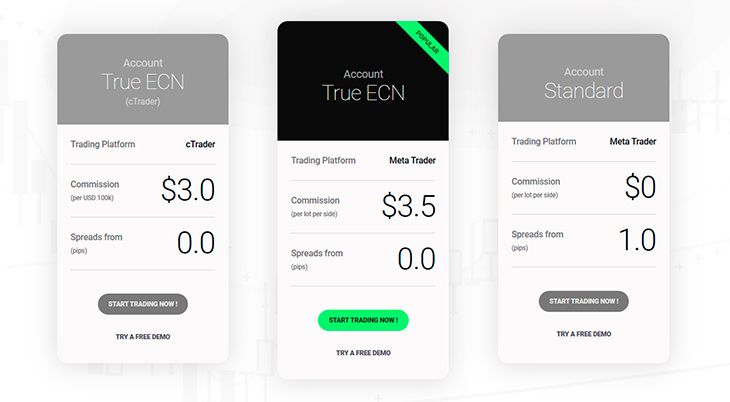

- True ECN Account on cTrader – This account features a commission of $3 per US$100k. The spreads start from 0.0pips.

- True ECN Account on MetaTrader – The commission is slightly higher for this account—$ 3.5 per lot per side. However, the spreads start from 0.0 pips.

- Standard Account on MetaTrader – This account features zero commission and the spreads start from 1.0 pips.

- Islamic Accounts – These are true ECN account where interest fees with be neither credited nor debited. Islamic accounts are also called swap free accounts. ICMarkets offers Islamic accounts on the cTrader as well as MetaTrader4 platforms.

Here are the basic features of an Islamic account:

- Trade 90+ instruments

- Leverage of 1:500

- Spreads starting from 0.0 pips

- Available on MT4 and MT5 platforms

- No extra costs in place of swaps

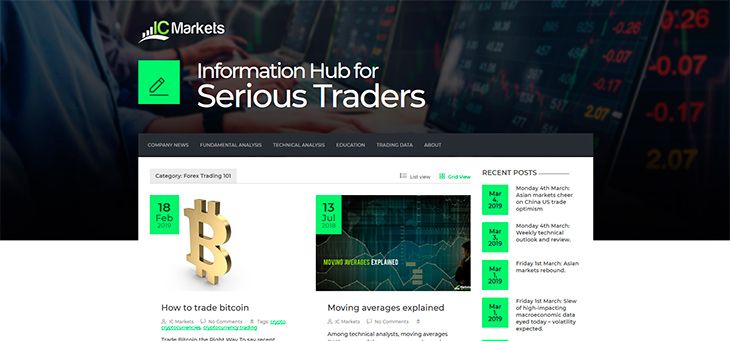

Get Free Forex Education at ICMarkets

Those who do not know much about forex trading and want to learn must visit the education section of IC Markets. This section includes the following educational material:

- Getting Started – This section teaches aspiring traders the general concepts of forex trading and some forex basis. It familiarizes clients on how the forex market works and introduces them to the basics of fundamental and technical analysis and the various factors that influence the forex market.

- Advantages – You can learn everything about the benefits of trading forex.

- Advantages of CFDs – This section shows traders exactly why index CFD trading is so popular. It also lists the various benefits of trading CFDs.

- Video Tutorials – You can view a wide range of educational videos for beginners, intermediates, as well as advanced traders. These video tutorials provide answers to most commonly asked questions about forex trading.

- WebTV – You can get market commentary and trading ideas in the form of short videos, which are recorded everyday from the New York Stock Exchange. IC Markets presents its WebTV in collaboration with Trading Central. It covers currencies, commodities, and global equities.

Assets for Trading

ICMarkets offers products that give you access to the most liquid and popular markets from all over the world.

The ranges of markets include the following:

- Forex – The forex market is open for trading 24 hours per day and five days per week. It offers 60 pairs of currencies, leverage of up to 1:500, deep liquidity, and spreads that start from 0.0 pips.

- Indices – You can enjoy commission free trading for 24 hours per day and five days per week across the major markets of the world. You can trade 17 indices on the cTrader, MT4, and MT5 platforms and enjoy leverage of up to 1:200.

- Commodities – Trade metals, agriculture, and energy as futures CFDs or currency pairs against USD. There are 19+ commodities to choose from along with leverage of up to 1:500.

- Stocks – Over 120 stocks from NYSE, Nasdaq, and ASX are available for trading. You can trade stocks on the MT5 platform and earn dividends.

- Bonds – Trade on six bonds without commission and leverage of up to 1:200. The bonds are issued by governments from different parts of the world such as Europe, US, UK, and Japan.

- Crypto – Cryptocurrency trading comes with leverage of up to 1:200. You can choose from 10 popular digital currencies.

- Futures – Choose from four global futures and trade them without commissions and a leverage of up to 1:200.

Choose Your Platform

IC Markets allows trading on the following platforms:

MetaTrader 4

The MT4 platform at IC Markets is different because of true ECN connectivity, which allows trading on institutional grade liquidity from leading hedge funds and investment banks from different parts of the world.

The MT4 platform has the following features:

- Fast execution of trade orders

- Spreads that start from 0.0 pips

- Unrestricted trading

- Flexible sizing of lots

- Wide range of withdrawals and deposit options

MetaTrader 5

Combined with the true ECN connectivity, MT5 becomes one of the most powerful trading platforms in the world, highly preferred by active traders.

MetaTrader WebTrader

This platform allows you to access your trading accounts right on your browser. It is compatible with a wide range of browsers and devices. In brief, it offers browser-based trading.

The MetaTrader platform is also available for Android, iPhone, iPad, and Mac.

cTrader

The cTrader platform was designed exclusively for true ECN connectivity. You can choose from the following cTrader platforms depending on how you would like to trade and the device you would like to use:

- cTrader Android

- cTrader cAlgo

- cTrader iPhone/iPad

- cTrader Web

Myfxbook AutoTrade for Copy Traders

AutoTrade is a copy trade service that belongs to Myfxbook. You can use this service to copy the trades of pros and experts. Traders using AutoTrade don’t have to pay fees based on volume or install any software. They just have to connect their trading account to Myfxbook and choose the system they would like to copy.

Myfxbook AutoTrade comes with the following features:

- Only for live accounts

- Shows only the best systems

- Accurate statistics

- 100% transparent services, no hidden fees

- Does not offer any volume-based incentives

- Add and remove systems whenever you wish

Guide to Making Deposits

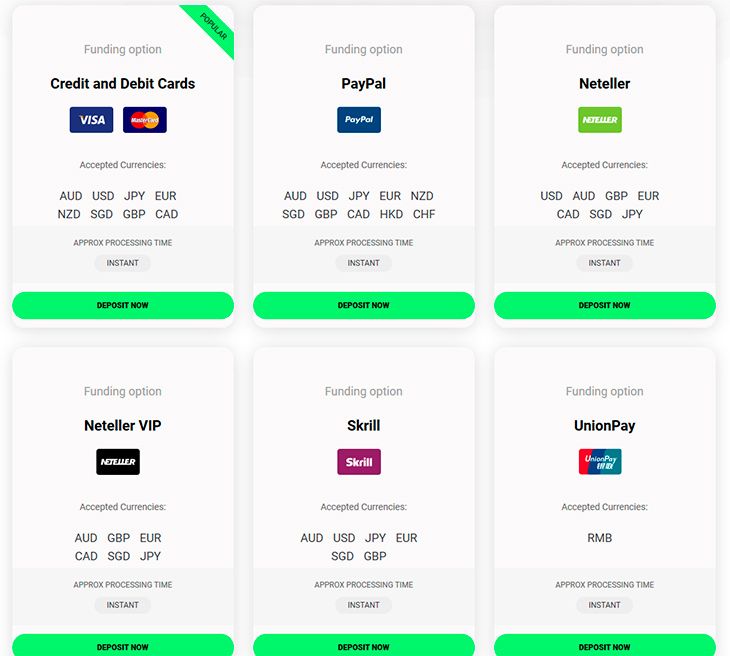

You can make deposits in 10 currencies using 15+ secure, reliable, and flexible funding methods.

Make instant deposits using the following:

- Visa & MasterCard credit/debit cards

- PayPal

- Neteller

- Skrill

- Qiwi Wallet

- Union Pay

- FasaPay

- POLi

- RapidPay

- Klarna

ICMarkets also offers Wire Transfer and broker to broker as deposit options, but the processing time for these methods is 2 – 5 banking days.

Guide to Withdrawing Profits

IC Markets processes payout requests fast, but clients can speed up the process by making withdrawal requests from their secure client areas. The cut off time for all payout requests is 12:00 AEST/AEDT. Requests received after this time will be processed on the next banking day.

Although the FX broker does not charge any fees for deposits and withdrawals, banks and financial institutions may charge transaction or currency conversion fees. Credit/debit card withdrawals take 3 – 5 business days. International bank wire withdrawals are charged AU$20, and the broker deducts this amount from the withdrawal amount.

Frequently Asked Questions

Is IC Markets scam?

No. the IC Markets is a True ECN forex broker. This means when you use their platform you easy access to the same Market that large institutions are trading. They do not have a dealing desk and as such at no time will they trade against you. IC Market is such a trustworthy partner.

Is the IC Market regulated?

You should trade with peace when dealing with the IC Market. This is because it is authorized and regulated by the Financial Services Authority (FSA) of Seychelles. It is one of the strictest financial bodies across the globe.

What is the minimum deposit in the IC Market?

Unlike other online trading platforms, the minimum deposit in the IC Markets is slightly higher. You are required to deposit a minimum of $200.

How do I withdraw money from my trading account?

If you want to withdraw funds from your trading account all you need is to submit a withdrawal request. All withdrawal requests received before 12:00 midday AEST / AEDT are processed within the same business day.

How long does it take to withdraw?

Following successful application to withdraw your funds from IC Markets account, credit or debit card withdrawals take at least 3 to 5days. The process may take longer depending on the bank's end. However, this is a rare case.

Can I transfer my funds between accounts?

Yes, it is easy for any trader to transfer funds between his/her trading accounts from inside the client area.

Does the IC Market offer deposit bonuses?

Unfortunately, you will receive no bonuses once you make any deposit on this trading platform.

Can I use the IC Markets platform while in the US?

Well, unfortunately, you cannot use this platform if you are within the United States of America. US CTFC has restricted US clients from using trading brokers outside the boundaries of the USA.

What is the raw spread in IC Markets?

On the IC Market trading platform, the raw spread is an account that offers some of the lowest possible spreads you will ever get. The average EUR/USD is 0.1 pips plus a commission of $3.50 per lot that is payable per side. This account was made for day traders, expert advisors, and scalpers.

What should I do if my account is hacked?

At any time should you feel that your security well-being of account has been compromised do not hesitate to act immediately. Change your password and contact the company immediately. To be on a safe side avoid storing your password on a shared device.

What leverage does IC Markets offer?

IC Markets offer flexible leveraging options that can lie anywhere from 1:1 to 1:500. You can change this on your trading account via your client area.

ICMarkets – Overall Rating

ICMarkets is a safe, secure, transparent, licensed & regulated, and highly reputed company. We couldn’t come across a single complaint or unresolved issue related to this broker.

If you are a serious trader who wants to reach new heights in your trading career, IC Markets is the best choice for you. If you are a newcomer, the broker will teach you how to become a pro. Get started with a demo account and spend some time practicing before you